Overview

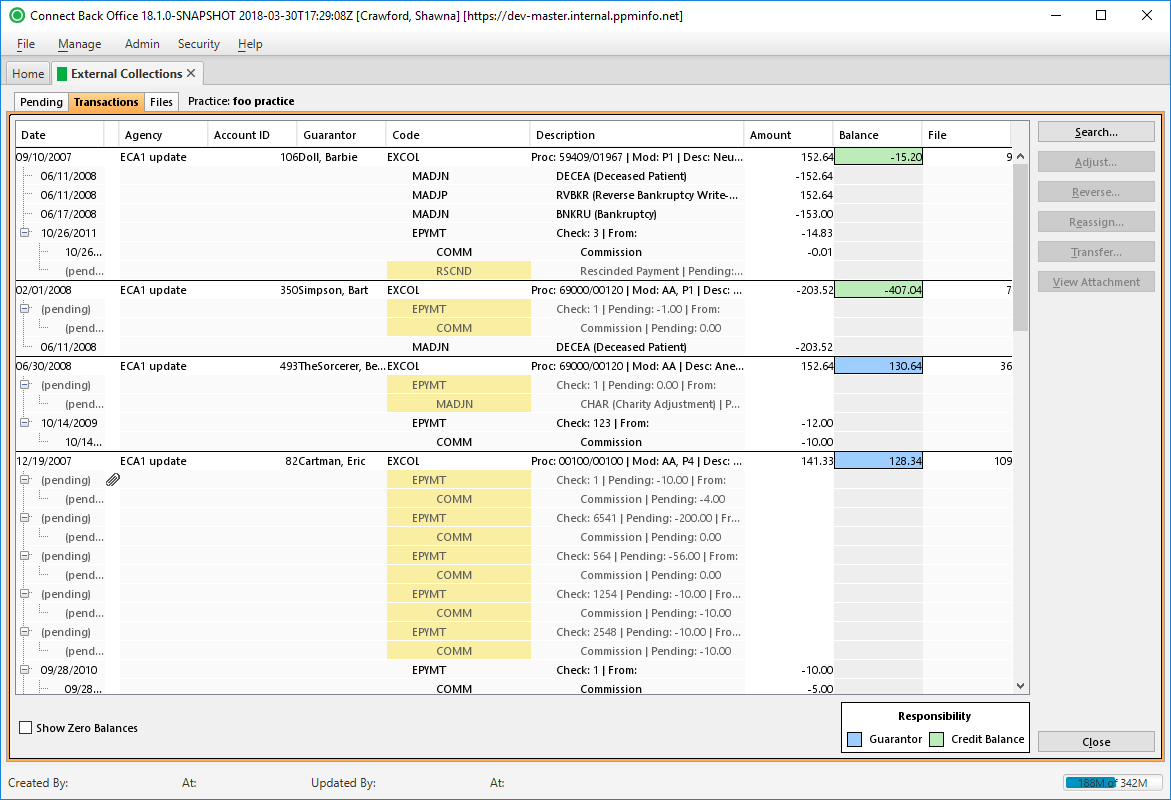

The Transactions tab is used to manage external collection transactions, which are the service fee lines of guarantor accounts that have been transferred from active AR to external collections.

A practice must be selected before transactions will display in the table. Select a practice via the Search button. The selected practice name appears in the header at the top of the page.

The Transactions tab is the permanent storage area of external collection transactions posted from the automated external collections process* or from the posting function on the Pending tab. The Transactions tab shows all activity recorded on an external collection transaction by activity code*, including any miscellaneous adjustments*. The activity and transaction codes are listed under the Code column on the external collection transaction where the activity was posted.

Automated External Collections Process

The automated external collections process is a nightly process controlled by the external collection rules that are configured for the practice. The external collection rules determine which external collection agency the external collection transactions are assigned to, how service fee lines are selected for transfer to external collections, whether the external collection transactions are automatically posted, and if the electronic file of the posted external collection transactions is automatically created.

The following occurs during the nightly process through the automated external collections process:

- If the balance and age thresholds are set, service fee lines of guarantor accounts are selected by outstanding balance and age and are queued for transfer from active AR to external collections.

- If the auto approval is set, service fee lines pending transfer from active AR to external collections are automatically posted to external collections and appear on the Transactions tab as external collection transactions.

- If the auto create file is set, the electronic file of the external collection transactions is automatically created for the external collection agency.

The automated options for posting and creating the electronic file can only be set if the balance and age thresholds are set.

Activity is recorded as a parent/child relationship with the EXCOL activity code identifying the external collection transaction as the parent. As other activity is recorded on the external collection transaction, the activity code for that activity is nested as children under its parent. For example, EXCOL is the parent to EPYMT, AGTFR, and RVCOL. Some children activity codes can be parents to other activity codes. For example, EPYMT is the parent of RVPAY.

Use the Transactions tab to manage all external collection transactions. When an external collection payment is recorded in payment entry, the outstanding balance of an external collection transaction is updated. While in external collections, an external collection transaction can be adjusted, reversed, or reassigned.

- The adjustment function allows you to adjust the outstanding balance of an external collection transaction, for example, a write-off. Adjustment activity is recorded as either MADJN or MADJP activity code.

The reversal function allows you to transfer the external collection transaction back to active AR as a service fee line of the guarantor account, reverse an external collections payment or commission. The activity codes that indicate a reversal are RVCOL, RVPAY, and RVCOMM.

The reassignment function allows you to assign the external collection transaction to a different external collection agency. This function can be managed manually from external collections or through the automated external collections process. The activity code is AGTFR on the external collection transaction being reassigned.

Automatic reassignments are managed through the automated external collections process by reassigning the external collection transaction based on its outstanding balance and the original age of the service fee line, not the age of the external collection transaction.

Field Definitions

Field | Type | Required | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Display Only (pulled from Account) | Yes | Dates associated with the service fee line and subsequent transactions. The date shown on the service fee line of the table reflects the date of service. All other lines reflect the posted date of the applicable transaction. If the transaction has not been posted, the word "pending" appears in the Date column. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency | Display Only (pulled from External Collections File) | Yes | The name of the external collection agency to which the external collection transaction is assigned. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Acct | Display Only (pulled from Account) | Yes | The account number of the guarantor account for the service fee line transferred to external collections. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guarantor | Display Only (pulled from Account) | Yes | The name of the guarantor responsible for the outstanding balance of the service fee line that was transferred to external collections. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Code | Display Only (pulled from Account) | Yes | The transaction code of the external collection transactions activity, e.g., EXCOL. Activity Code The following is an alphabetical listing of the activity codes that might appear on the Transactions tab according to the type of transaction activity recorded:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Description | Display Only (pulled from Account) | Yes | The description of the procedure for the service fee line transferred to external collections. Transaction Codes for Miscellaneous Adjustments The transaction codes for the miscellaneous adjustment activity codes. MADJN and MADJP are listed as follows:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount | Display Only (pulled from Account) | Yes | The amount of the transaction recorded on the external collection transaction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Display Only (pulled from Account) | Yes | The current balance of the external collection transaction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| File | Display Only (pulled from External Collections File) | Yes | The ID of the electronic file the external collection transaction is in. |

Button Descriptions

Button | Shortcut Keys | Description | Step-By-Step Guides |

|---|---|---|---|

| Search | [Alt] + [S] | To search and locate external collections transactions for a practice. |

|

| Adjust | [Alt] + [A] | Opens the External Collection Transaction Adjustment window for entering the amount the external collection transaction is being adjusted. | Adjusting External Collection Transactions |

| Reverse | [Alt] + [R] | Opens the Reverse External Collection Transaction window for recording the reason the external collection transaction is being reversed. This action transfers the external collection transaction back to active AR as a service fee line of the guarantor account. | Reversing External Collection Transactions |

| Reassign | [Alt] + [E] | Opens the Reassign External Collection Transaction window for selecting the external collection agency to which the external collection transactions are being assigned. | Reassigning External Collection Transactions |

| Transfer | [Alt] + [T] | Opens the External Collections Transfer window for transferring the service line from external collection back to Active AR. | Transferring Service Fee Lines to Active AR |

| View Attachment | [Alt] + [V] | Opens the Image Viewer window for previewing the image attached to the external collection payment. If the payment has an image attached, the appears in the row where the EPYMT is recorded. |

|