Overview

| Panel | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||

|

(Click an image below to enlarge.)

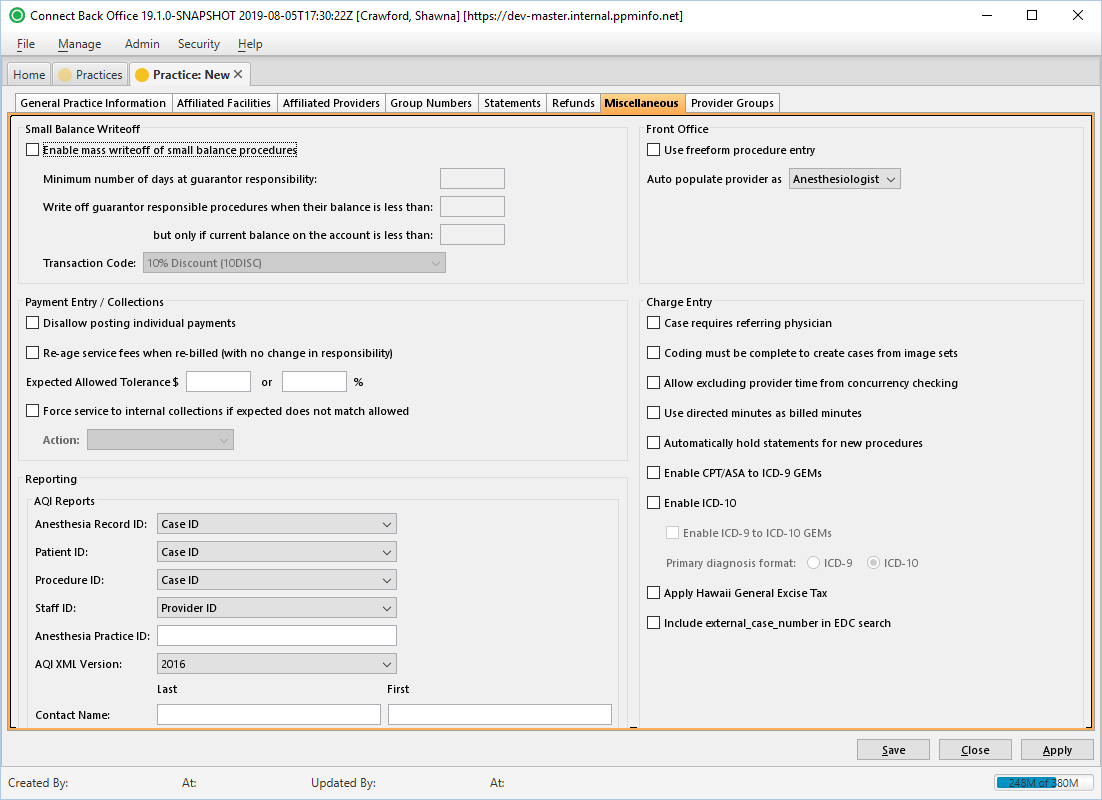

Practice: New Page / Miscellaneous Tab

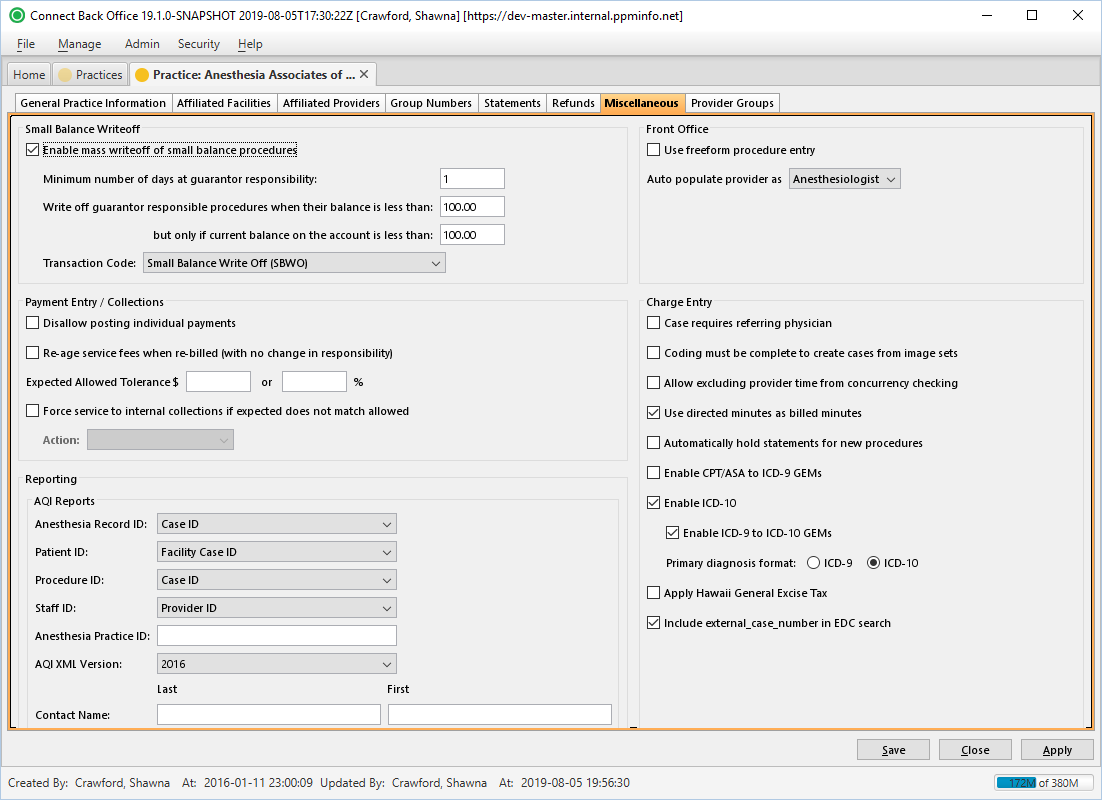

Practice: [name] Page / Miscellaneous Tab

Field Definitions

Field | Type | Required | Description | ||||||

| Small Balance Writeoff Section | |||||||||

| Enable mass writeoff of small balance procedures | Checkbox | No | Specifies criteria for automatically writing off small balances that originated from a procedure. A small balance must meet all of the following criteria to be eligible for writeoff:

| ||||||

| Transaction Code | Drop Down | No | Specifies what transaction code the small balance writeoff is posted under. Required if Enable mass writeoff of small balance procedures is selected. | ||||||

| Payment Entry / Collections Section | |||||||||

| Disallow posting individual payments | Checkbox | No | Prevents the posting of individual payments within a payment batch. When this option is selected, payments may only be posted from the Payment Batches page. This option is available only when the Payment Batch: [ID] > Expected Count and Expected Total values match what was entered during payment entry. | ||||||

| Re-age service fees when re-billed (with no change in responsibility) | Checkbox | No | Resets the responsible balance date to the rebill date, given that responsibility remains the same (guarantor to guarantor, primary to primary, etc.). If unchecked, the original bill date is recognized as the responsible balance date. Option is checked by default. | ||||||

| Expected Allowed Tolerance | Free Text (Numeric) | No | Specifies the over-under criteria that the Actual Allowed amount from an EOB must exceed the Expected Allowed amount for inclusion in the Payment Exceptions Report, which is generated from the Payment Batch [ID] page in Back Office. If an Actual Allowed amount from an EOB exceeds the set thresholds, the amounts entered in these fields determine if the payment is included in the report. You may enter either a dollar amount or a percentage (of the total expected allowed amount). If both values are entered, the inclusion in the report is decided based on the lesser amount.

| ||||||

| Force service to internal collections if expected does not match allowed | Checkbox | No | Forces service fee lines outside of the Expected Allowed Tolerance range to internal insurance collections and the assigned Action Type assigned is initiated. Examples:

| ||||||

| Action Type | Drop Down | No | Defines the type of action initiated if the services fee lines are outside the Expected Allowed Tolerance range and sent to internal insurance collections. Only enabled and required if Force service to internal collections if expected does not match allowed is checked. | ||||||

| Reporting Section | |||||||||

| AQI Reports Sub-section | Facilitates customization of data sent to AQI. | ||||||||

| Anesthesia Record ID | Drop Down | Yes | The entity selected in the drop down determines the value pulled from the Connect database and reported in the Anesthesia Record ID field of a generated AQI XML file. Options include: Case ID, External Case ID, Facility Case ID, any custom-created fields. | ||||||

| Patient ID | Drop Down | Yes | The entity selected in the drop down determines the value pulled from the Connect database and reported in the Patient ID field of a generated AQI XML file. Options include: Case ID, External Case ID, Facility Case ID, any custom-created fields. | ||||||

| Procedure ID | Drop Down | Yes | The entity selected in the drop down determines the value pulled from the Connect database and reported in the Procedure ID field of a generated AQI XML file. Options include: Case ID, External Case ID, Facility Case ID, any custom-created fields. | ||||||

| Staff ID | Drop Down | Yes | The entity selected in the drop down determines the value pulled from the Connect database and reported in the Staff ID field of a generated AQI XML file. Options include: Provider ID, Tax ID_NPI. | ||||||

| Anesthesia Practice ID | Free Text | No | Allows the entry of an alphanumeric value. The value represents the Practice ID for AQI reporting purposes. | ||||||

| QI Number (Fides) | Drop Down | Yes | Unique ID that populates the Fides Report (QI Number Segment) based on the selection made in this field. Options include: External Case ID, Facility Case ID, any custom-created fields. | ||||||

| Front Office Section | |||||||||

| Use freeform procedure entry | Checkbox | No | If checked, allows freeform typing in the Procedure field, which is located on the New Patient/Provider Appointment window in Front Office. | ||||||

| Auto populate provider as | Drop Down | Yes | The options include:

| ||||||

| Charge Entry Section | |||||||||

Case requires referring physician | Checkbox | No | Designates the Referring Physician field as required in Back Office. | ||||||

Coding must be complete to create cases from image sets | Checkbox | No | Blocks the creation of a case from an image set in Back Office before the Coding form is completed in Image Batches of Back Office. To restrict cases from being created from image sets before the Coding status is complete, check the box. To allow cases from image sets regardless of the Coding status, leave the checkbox blank. | ||||||

Allow excluding provider time from concurrency checking | Checkbox | No | Allows users of Connect Back Office to check the Exclude (provider time segment) from concurrency checking option when using the Add/Update Provider Time form in charge entry. Excluded minutes will continue to be considered in total case time and start/stop time. When a time segment is excluded, a pop-up alert appears. | ||||||

Use directed minutes as billed minutes | Checkbox | No | Uses the directed provider's minutes as the billed minutes for the purpose of calculating directed provider billed minutes and time units.

| ||||||

Automatically hold statements for new procedures

| Checkbox | No | Hold statements for all new cases and procedures at the practice level. Once this box is checked, Connect Back Office automatically checks the Hold Statement checkbox in charge entry on all new procedures. The charge entry Hold Statement option also automatically becomes unavailable to the user until the box is unchecked. When held procedures are highlighted in charge entry, an indicator appears in the Procedure Details section. | ||||||

Enable CPT/ASA to ICD-9 GEMs (General Equivalence Mappings) | Checkbox | No | Populates ICD-9 Code line in Back Office charge entry (Add/Update Procedure window) with potential diagnosis code matches based on the CPT code(s) entered. | ||||||

Enable ICD-10 | Checkbox | No | Enables the ICD-10 fields and drop downs in Back Office charge entry (Add/Update Procedure window). | ||||||

| Enable ICD-9 to ICD-10 GEMs (General Equivalence Mappings) | Checkbox | No | Populates mapping options between ICD-9 and ICD-10 diagnosis codes. This functionality maps ICD-9 codes to ICD-10 codes only. For example, if ICD-9 is selected as the Primary diagnosis format and an ICD-9 Code is selected, the GEM Scenario and Choice Selection window appears and allows the user to choose an ICD-10 code to map the codes. If Enable CPT to ICD-9 GEMs is unchecked and the ICD-9 code entered is not associated with the Procedure (CPT) code, an error advises the user that the ICD-9 code is not associated with the CPT. If ICD-10 is set as the primary diagnosis format, the Enable CPT to ICD-9 GEMs option does not function, regardless of whether it is checked. The system will instead identify only ICD-9 code crosswalks for the selected ICD-10 code. | ||||||

| Primary diagnosis format | Radio Selection | No | Determines the ICD code set (9 or 10) that displays in the primary position (left side of the ICD code area). It also determines how the Enable ICD-9 to ICD-10 GEMs and Enable CPT to ICD-9 GEMs behave (see above). | ||||||

| Apply Hawaii General Excise Tax | Checkbox | No | If checked, the Hawaii General Excise Tax is applied to claim totals in charge entry. |